The price of a commodity refers to the monetary value at which it is bought or sold in the market. Commodities that are grown rather than mined are referred to as soft commodities. In the context of the chocolate industry, the commodity usually refers to cocoa beans, which are the primary ingredient in chocolate production.

The price of cocoa beans is influenced by various factors such as supply and demand dynamics, weather conditions, geopolitical events, and currency fluctuations.

The price of cocoa beans can have a significant impact on the chocolate industry as it directly affects the cost of production for chocolate manufacturers. When the price of cocoa beans is high, chocolate manufacturers may face higher production costs, which can lead to increased prices for chocolate products. Conversely, when the price of cocoa beans is low, chocolate manufacturers may have more flexibility in pricing their products.

Understanding the price of cocoa beans is crucial to anticipate and manage potential cost fluctuations. By closely monitoring market trends and factors that influence cocoa bean prices, chocolate industry professionals can make informed decisions regarding sourcing, production, and pricing strategies.

The price of cocoa beans is primarily determined by the global supply and demand dynamics. The main factors influencing cocoa bean prices include weather conditions (such as droughts or floods), political instability in cocoa-producing regions, changes in consumer demand, and currency exchange rates.

For example, a decrease in cocoa production due to adverse weather conditions can lead to a decrease in supply, resulting in higher prices. On the other hand, an increase in demand for chocolate products can also drive up cocoa bean prices. Additionally, fluctuations in currency exchange rates can impact cocoa bean prices, especially for countries that export or import cocoa beans.

In 2016, the price of cocoa beans experienced a significant increase due to a combination of factors, including a decline in production in major cocoa-producing countries, such as Ghana and Ivory Coast, and increased demand for chocolate products. This led to higher production costs for chocolate manufacturers, who then passed on the increased costs to consumers by raising the prices of chocolate products. One can examine the recent and historical trends (over the past 50 years) of commodity pricing of cocoa on The Trading Economics website.

Próximamente versión en español

Entry added: July 31, 2023

Verified on: September 14, 2023

Authored by

Robert Thibodeaux, Operations

Chocolatier

References

“Monthly Review of the Market,” ICCO, Accessed on August 23, 2023.

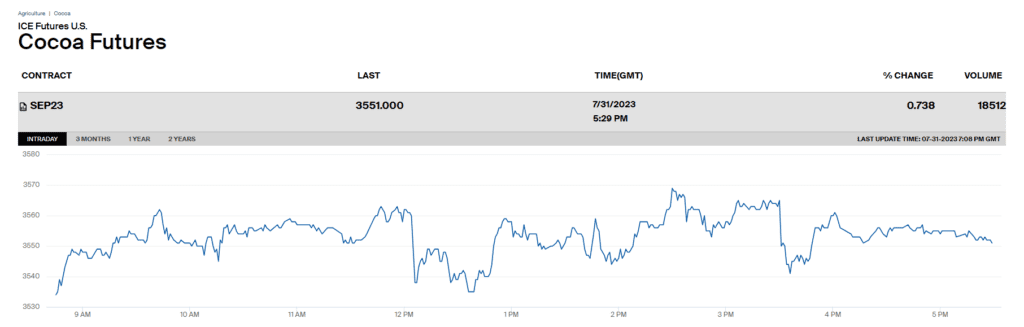

“Cocoa Futures,” Intercontinental Exchange (ICE), Accessed on August 23, 2023.

“Cocoa Futures – Quotes,” CME Group, Accessed on August 23, 2023.

“Soft Commodity: Meaning and Examples vs. Hard Commodities,” James Chen, Investopedia, May 27, 2022.

Have a comment on this definition?